45 formula for coupon rate

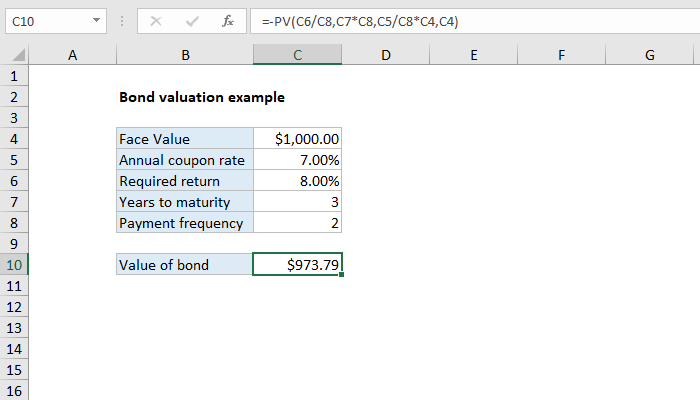

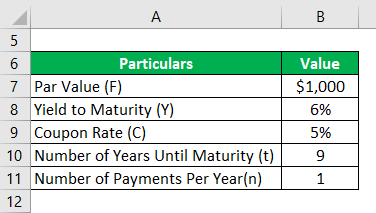

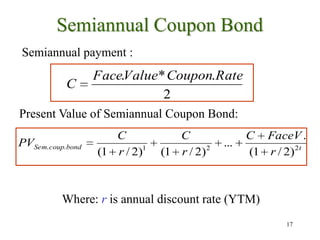

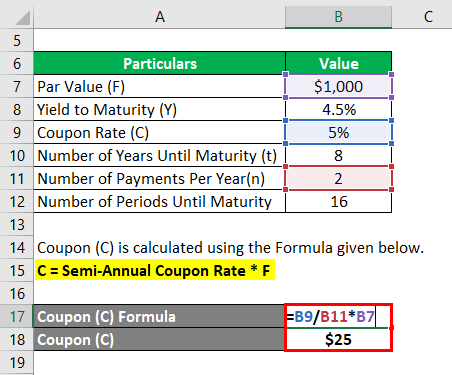

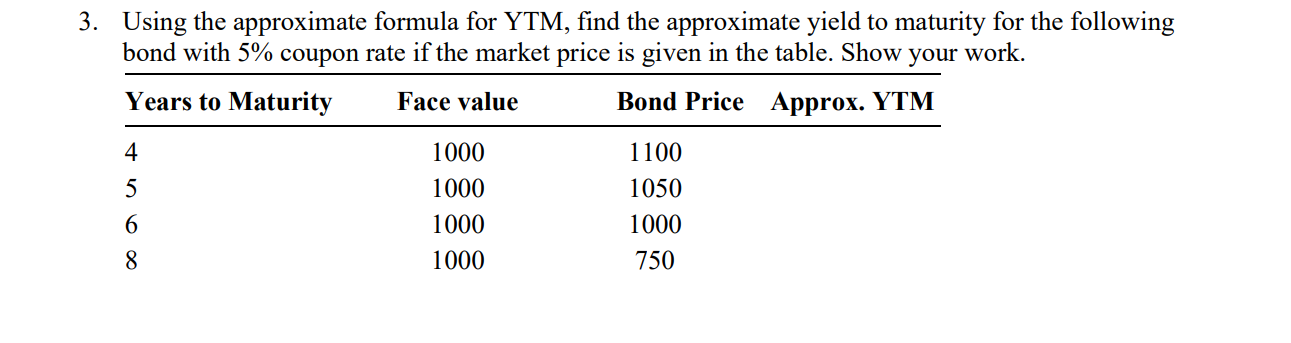

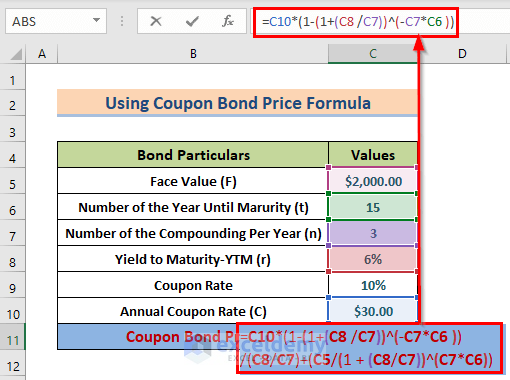

Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

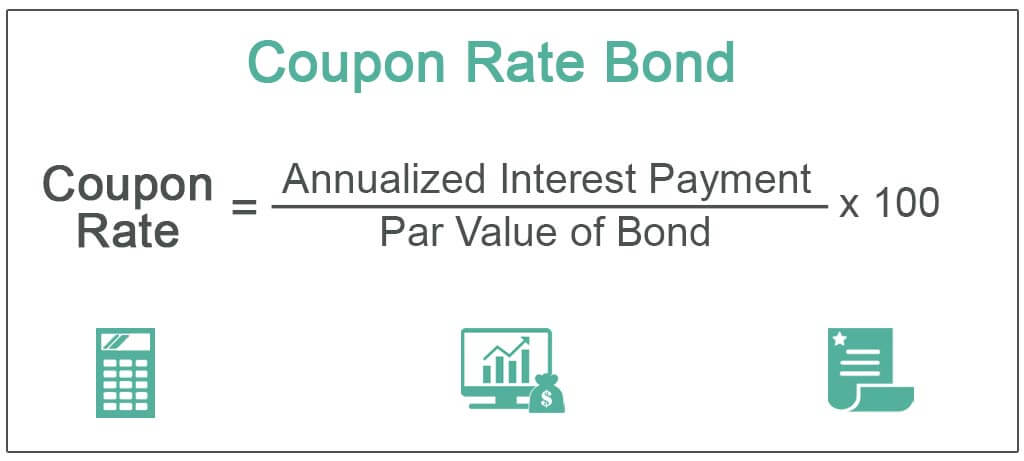

Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

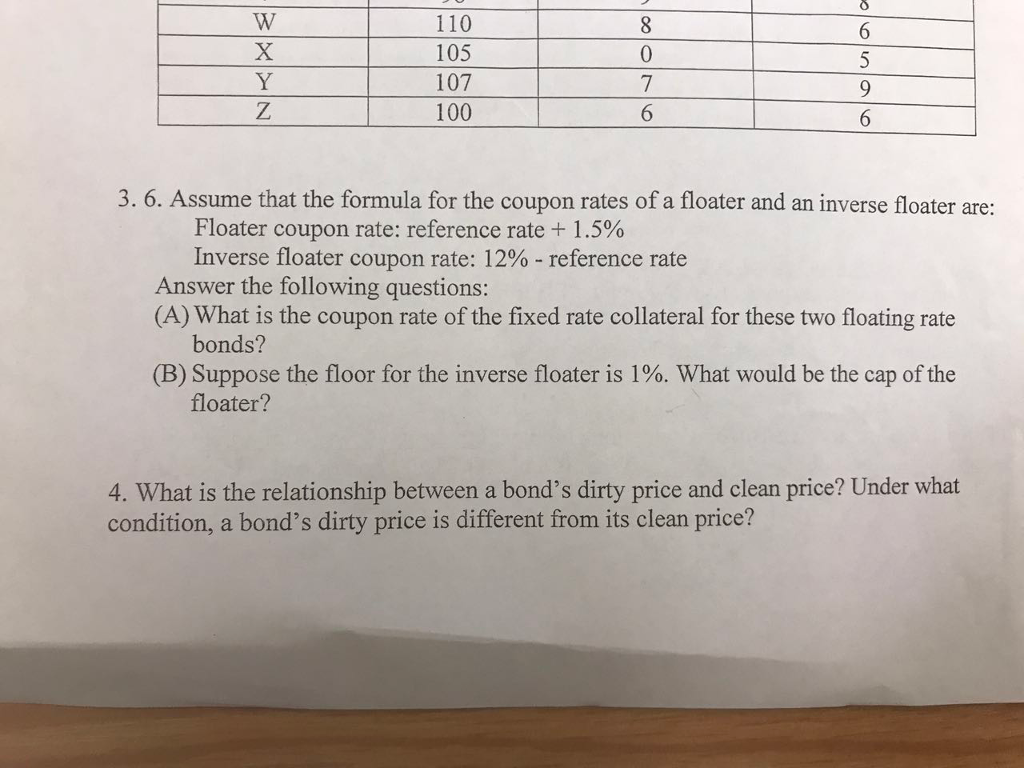

Formula for coupon rate

Coupon Equivalent Rate (CER) Definition - Investopedia The coupon equivalent rate (CER) is calculated as: Find the discount the bond is trading at, which is face value less market value. Then divide the discount by the market price. Divide 360 by the... Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. What Is a Coupon Rate? - Investment Firms Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

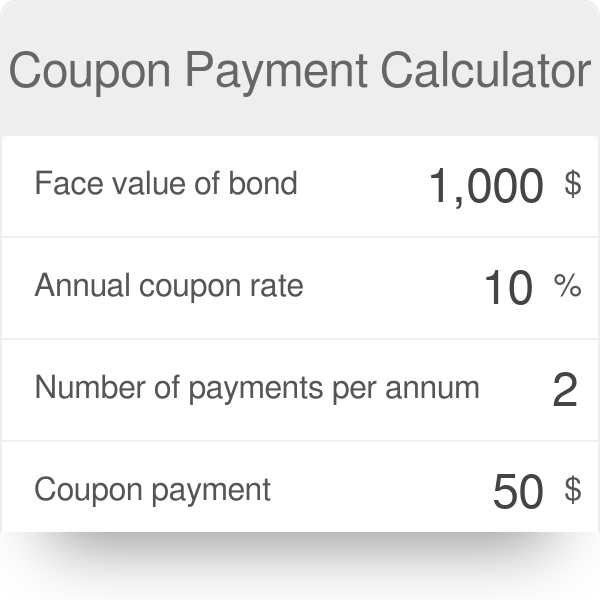

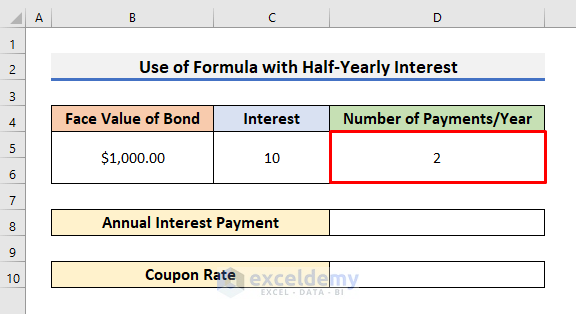

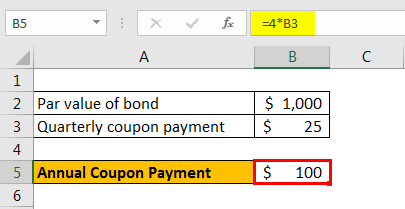

Formula for coupon rate. Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p. where: C = coupon rate. i = annualized interest (or coupon) p = par value of bond.

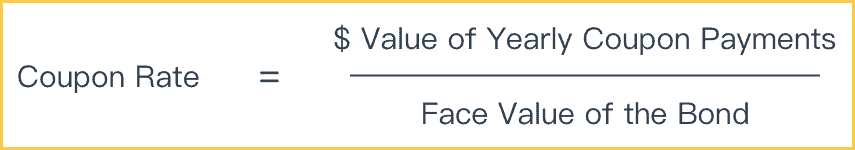

Coupon Rate Formula | Simple-Accounting.org If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. Current yield compares the coupon rate to the current market price of the bond.For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond’s par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article … Formula to calculate the coupon rate of a bond| Knowledge Center IIFL ... The formula to calculate the coupon rate of a bond is: Coupon Rate = (Annual Coupon Payment / Face Value of Bond) * 100. Let's say you want to buy a Rs 1,000 bond that pays Rs 40 in interest every ... Discount Rate Formula | How to calculate Discount Rate with ... Discount Rate = ($3,000 / $2,200) 1/5 – 1 Discount Rate = 6.40% Therefore, in this case the discount rate used for present value computation is 6.40%. Discount Rate Formula – Example #2

Annualized Rate of Return Formula | Calculator | Example ... The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Forward Rate Formula | Formula | Examples with Excel Template While the spot rate of interest for three years is 8.2% p.a and spot yield for five years is 10.4% p.a on zero-coupon bonds. Solution: Forward Rate is calculated using the formula given below Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. ... Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio Business Financial Insolvency Ratio Cap Rate Capital Gains Yield Capitalization Rate Cash To ...

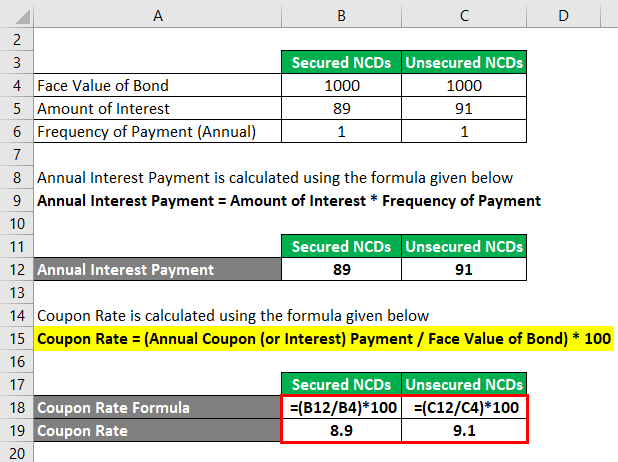

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

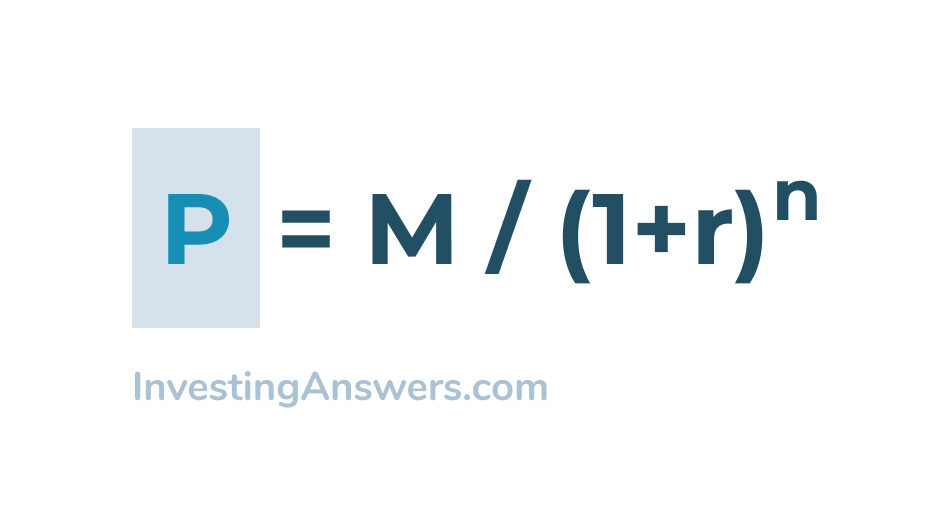

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ...

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example Georgia has a 10-year bond of company XYZ with a nominal value of $1,000 and a 20-year maturity. The rate pays 8% annually.

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ...

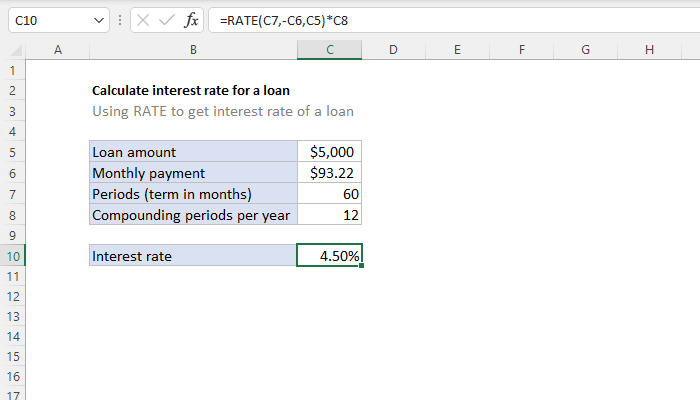

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

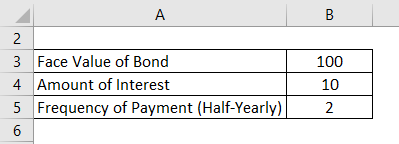

Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond....

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

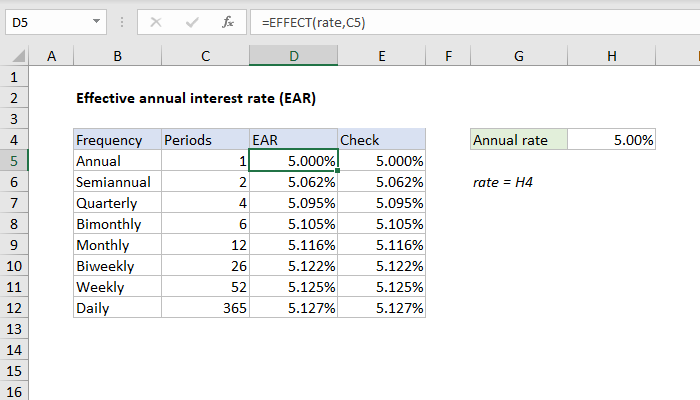

Effective Tax Rate Formula | Calculator (Excel Template) - EDUCBA Effective Tax Rate = 20.2% Explanation. Because of the progressive tax system, all the income will not be taxed at the same rate. So individuals and companies will pay different tax for different levels of income.

Coupon Rate - What it is, Formula, & Example - Speck & Company In this case, our coupon value is $12.5 but our coupon rate is still 2.5% since the coupon rate is the annual sum of coupon payments divided by the face value of the bond. Formula: Market Effect on Coupon Rate. What happens if the market value of the bond changes or if interest rates change? This is where the coupon rate loses its value as a ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

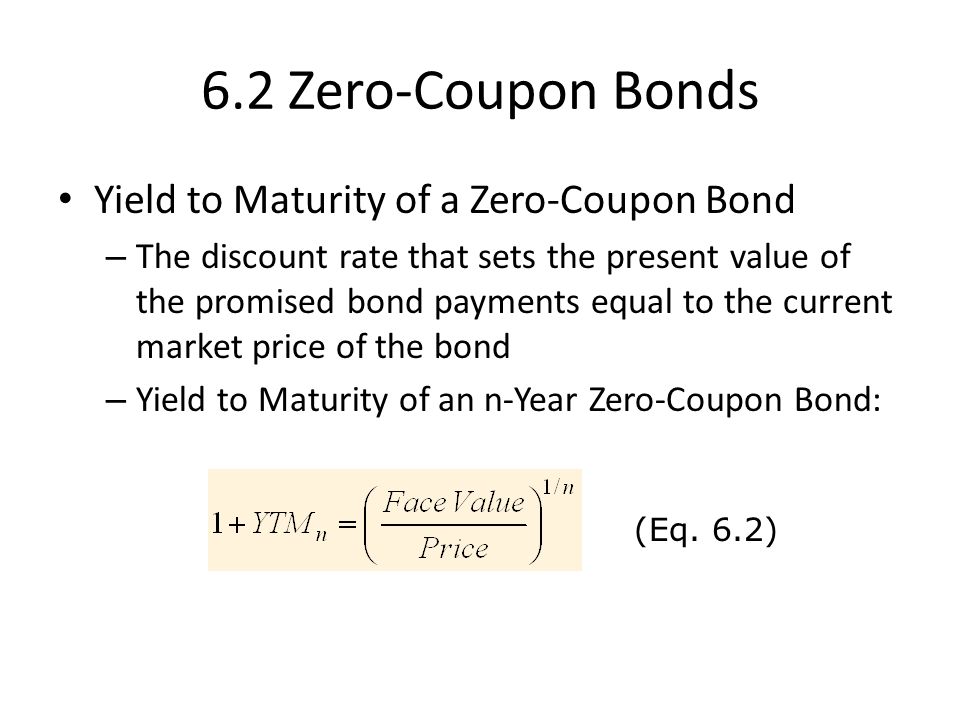

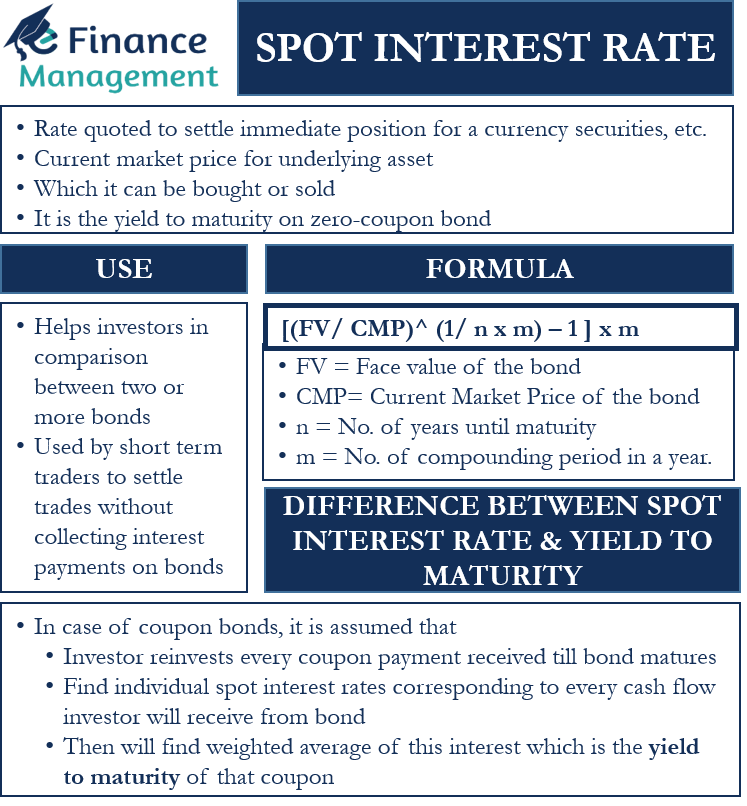

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left (\frac12\right)-1}\end {aligned} = ( 9251000)(21)−1 When solved, this equation produces a value of...

What Is a Coupon Rate? - Investment Firms Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Coupon Equivalent Rate (CER) Definition - Investopedia The coupon equivalent rate (CER) is calculated as: Find the discount the bond is trading at, which is face value less market value. Then divide the discount by the market price. Divide 360 by the...

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 formula for coupon rate"